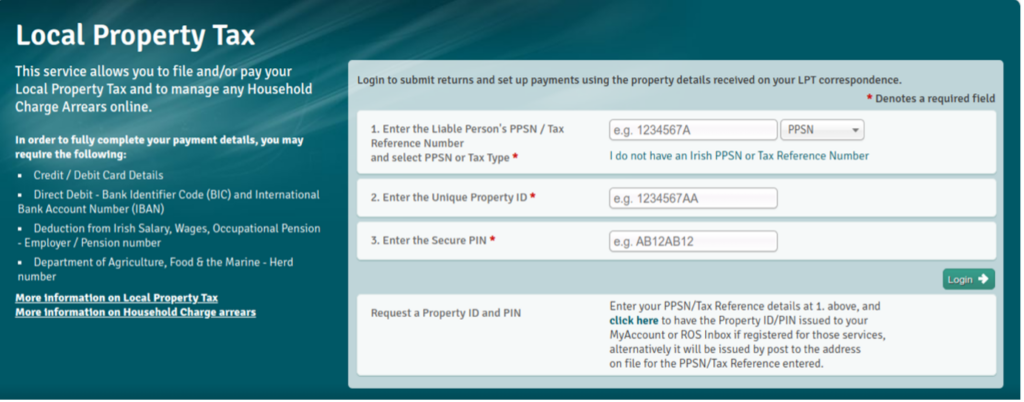

Abbreviated to LPT, Local Property Tax was introduced in Ireland in 2013. It is a self-assessment tax that must be paid annually by anyone who owns a residential property (even if you do not live there).

The tax that is due depends on your own assessment of the market value of your property according to Revenue guidelines. This value fits into one of 20 different LPT bands each with their own standard rate of tax.

Until recently, both the bands and the rate of tax had been exactly the same since LPT was introduced. However, this year the ranges of each band have been amended to reflect the increase in property values.

The Band Structure

In the table below, you can see the current valuation bands – structure along with their associated charges.

Band Structure |

||

| Band | Property Value (€) | Charge (€) |

| 1 | 1 -200,000 | 90 |

| 2 | 200,000 -262,500 | 225 |

| 3 | 262,501 – 350,000 | 315 |

| 4 | 350,000 -437,500 | 405 |

| 5 | 437,501- 525,000 | 495 |

| 6 | 525,001-612,500 | 585 |

| 7 | 612,501 – 700,000 | 675 |

| 8 | 700,001- 787,500 | 765 |

| 9 | 787,501 – 875,000 | 855 |

| 10 | 875,001 – 962,500 | 945 |

| 11 | 962,501 – 1,050,000 | 1,035 |

| 12 | 1,050,001 – 1,137,500 | 1,190 |

| 13 | 1,137,501 – 1,225,000 | 1,409 |

| 14 | 1,225,001 – 1,312,000 | 1,627 |

| 15 | 1,312,501 – 1,400,000 | 1,846 |

| 16 | 1,400,001 – 1,487,500 | 2,065 |

| 17 | 1,487,501 – 1,575,000 | 2,284 |

| 18 | 1,575,001 – 1,662,500 | 2,502 |

| 19 | 1,662,501 – 1,750,000 | 2,721 |

| 20 | 1,750,001+ | 2,830+ |

All property owners in Ireland must submit a valuation of their property based on the above LPT tax bands, valuation(s) is to be reviewed, renewed and submitted to revenue every 4 years thereafter.

How do I value my property?

LPT is a self-assessed tax, meaning you need to calculate your own liability.

However, Revenue provides thorough guidelines to help you find the correct valuation band, which you can find here.

The valuation tool takes into account average values for property in your area along with specifics of your own property.

If you use any supporting documentation to determine the market value of your property, make sure to keep it on hand.

Revenue may request this from you in the event of a review of your self-assessment.

What about properties over €1,750,00?

Homes valued in band 20 do not have a fixed charge. Instead, you will need to declare an actual valuation of the property.

Using a property valued at €1,750,00 as an example, you can see how the LPT will be reached below.

The LPT is reached using three calculations.

First, find 0.1029% of the first €1.05 million of declared market value of the property (0.10% of 1,050,000 = 1,080).

Then you must add 0.25% of the portion of the declared market value between €1.05 million and €1.75 million.

For a property valued at €1.75 million this portion is €700,00 (1,750,000 – 1,050,000). 0.25% of 700,000 = 1,750.

Finally, you must add 0.3% of the portion of the declared market value above €1.75 million.

In this example, nothing else needs to be added. So to reach an estimate of LPT, you add together the first two calculations.

This leaves you with 1,080 + 1,750 = 2830.

Here are the calculations in a table if you find that easier to work with.

| House Value | €1,750,000 | |

| 0.10% | €1,080 | (0.1029% of the first €1.05 million of declared market value of the property) |

| + | ||

| 0.25% | €1,750 | (0.25% of the portion of the declared market value between €1.05 million and €1.75 million) |

| + | ||

| 0.30% | 0 | (0.3% of the portion of the declared market value above €1.75 million) |

| = | ||

| LPT Estimate 2021 | €2,830 |